Delve into the world of Long Home Improvement Financing Options Explained, where we uncover the ins and outs of financing your home projects for the long haul. From understanding different financing types to weighing the pros and cons, this guide has you covered.

Understanding Long-Term Home Improvement Financing

When it comes to home improvement projects, financing plays a crucial role in determining the feasibility and success of the endeavor. Long-term home improvement financing refers to borrowing money over an extended period, typically several years, to fund renovation, remodeling, or repair projects for your home.

Common Long-Term Financing Options

- Home Equity Loans: This type of loan allows you to borrow against the equity in your home, providing a lump sum amount that can be used for significant home improvement projects.

- Home Equity Line of Credit (HELOC): Similar to a credit card, a HELOC allows you to borrow against the equity in your home as needed, making it a flexible financing option for ongoing or unpredictable expenses.

- Personal Loans: While typically shorter in term, personal loans can still be considered a long-term financing option for smaller home improvement projects, offering fixed monthly payments over a set period.

- Cash-Out Refinance: This involves refinancing your mortgage for a higher amount than you currently owe and receiving the difference in cash, which can be used for home improvements.

Benefits of Long-Term Financing

- Predictable Payments: Long-term financing options often come with fixed interest rates and monthly payments, making it easier to budget and plan for the expenses associated with your home improvement project.

- Lower Interest Rates: Long-term loans typically offer lower interest rates compared to short-term financing options, resulting in potentially significant savings over the life of the loan.

- Ability to Tackle Larger Projects: With access to a substantial amount of funds over an extended period, long-term financing options allow homeowners to take on more extensive and costly home improvement projects that may not be feasible with shorter-term loans.

Types of Long-Term Home Improvement Financing

When considering long-term financing options for home improvements, homeowners have several choices available to them. Each type of financing comes with its own set of eligibility requirements and scenarios where it would be most suitable.

Home Equity Loans

Home equity loans are a type of loan where the borrower uses the equity in their home as collateral. This type of financing usually offers fixed interest rates and a lump sum payment, making it ideal for larger home improvement projects where the cost is known upfront.

HELOCs

Home Equity Lines of Credit (HELOCs) also use the home's equity as collateral but operate more like a credit card with a revolving line of credit. This type of financing is suitable for ongoing projects or homeowners who prefer flexibility in accessing funds as needed.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes, including home improvements. They often have higher interest rates compared to home equity loans but are easier to qualify for. Personal loans are ideal for smaller projects or homeowners who do not have significant equity in their homes.

FHA 203(k) Loans

FHA 203(k) loans are backed by the Federal Housing Administration and are specifically designed for home improvements. These loans can include the cost of the home purchase and renovation expenses into one loan, making them suitable for homebuyers looking to renovate a fixer-upper.

Pros and Cons of Long-Term Home Improvement Financing

When considering long-term financing options for home improvement projects, it is essential to weigh the benefits and drawbacks associated with these choices.

Advantages of Opting for Long-Term Financing

- Lower monthly payments: Long-term financing typically offers lower monthly payments compared to short-term options, making it easier to manage your budget.

- Ability to tackle larger projects: With long-term financing, you can take on more extensive home improvement projects that may require a higher budget.

- Flexibility in repayment: Long-term financing often provides more flexible repayment terms, allowing you to tailor the payments to suit your financial situation.

Potential Drawbacks of Long-Term Financing Options

- Higher total interest paid: While monthly payments may be lower, long-term financing usually results in paying more interest over the life of the loan compared to short-term options.

- Extended commitment: Long-term financing means committing to regular payments over an extended period, which may limit your financial flexibility in the future.

- Risk of overborrowing: With the ability to take on larger projects, there is a risk of overborrowing and accumulating more debt than necessary.

Impact of Interest Rates, Repayment Terms, and Collateral Requirements

- Interest rates: Higher interest rates can significantly increase the total cost of long-term financing, making it important to shop around for the best rates.

- Repayment terms: Longer repayment terms can lower monthly payments but result in paying more interest over time. Shorter terms may have higher payments but lower overall interest costs.

- Collateral requirements: Some long-term financing options may require collateral, such as your home, which poses a risk of losing the asset if you default on the loan.

Tips for Choosing the Right Long-Term Financing Option

When it comes to selecting a long-term financing option for home improvement projects, homeowners need to consider several factors to make an informed decision. Proper evaluation and comparison of different financing offers, as well as budgeting and financial planning, are essential steps in ensuring that the chosen option aligns with their financial goals and capabilities.

Considerations for Choosing Long-Term Financing

- Interest Rates: Compare interest rates offered by different lenders to find the most competitive option that suits your budget.

- Loan Terms: Evaluate the repayment period and monthly installments to ensure they are manageable and fit your financial situation.

- Fees and Charges: Look out for any hidden fees or charges associated with the financing option to avoid unexpected costs.

- Flexibility: Choose a financing option that offers flexibility in terms of repayment schedules and prepayment options.

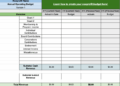

Step-by-Step Guide to Evaluating Financing Offers

- Research: Conduct thorough research on different lenders and financing products available in the market.

- Compare Rates: Compare interest rates, loan terms, and fees of each financing offer to determine the most cost-effective option.

- Check Eligibility: Ensure you meet the eligibility criteria set by the lender before applying for a long-term financing option.

- Read the Fine Print: Carefully read the terms and conditions of the financing offer to understand the repayment obligations and any penalties involved.

Importance of Budgeting and Financial Planning

Before committing to a long-term home improvement financing plan, it is crucial to create a detailed budget and financial plan. This will help you determine how much you can afford to borrow, how the monthly payments will impact your budget, and how you can manage your finances effectively to repay the loan on time.

Ultimate Conclusion

As we wrap up our discussion on Long Home Improvement Financing Options Explained, remember that making informed choices about financing can set you on the path to achieving your dream home. Take charge of your projects with the right financial plan in place.

FAQs

What are the eligibility requirements for FHA 203(k) loans?

To qualify for an FHA 203(k) loan, you typically need a credit score of at least 580 and a minimum down payment of 3.5%. Additionally, you must have a steady income and meet specific debt-to-income ratio requirements.

What are the potential drawbacks of choosing a home equity loan for financing?

One drawback of a home equity loan is that your home serves as collateral, putting it at risk if you fail to make payments. Additionally, if property values drop, you could end up owing more than your home is worth.

How can homeowners evaluate different financing offers effectively?

Homeowners should compare interest rates, repayment terms, fees, and overall costs of different financing options. It's essential to consider the total amount repaid over the loan term to assess the best offer.